unrealized capital gains tax meaning

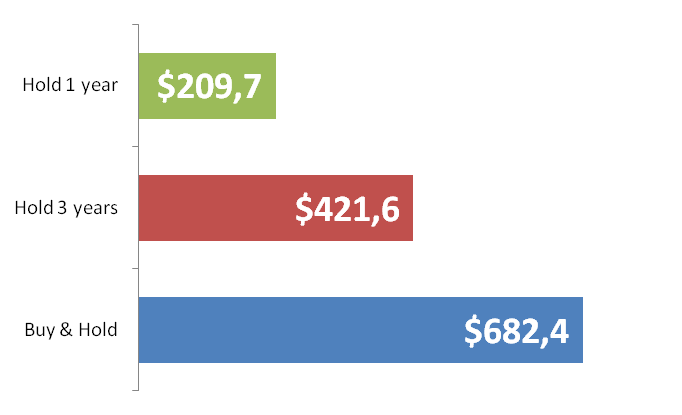

A gain or a loss becomes realized when you sell the investment. Unrealized gains are not taxed until you sell the investment and the gain is realized.

Looking Back On Taxation Of Capital Gains Mark To Market Means To Pay On Unrealized Capital Gains Annuall Stock Market Capital Gain Savings And Investment

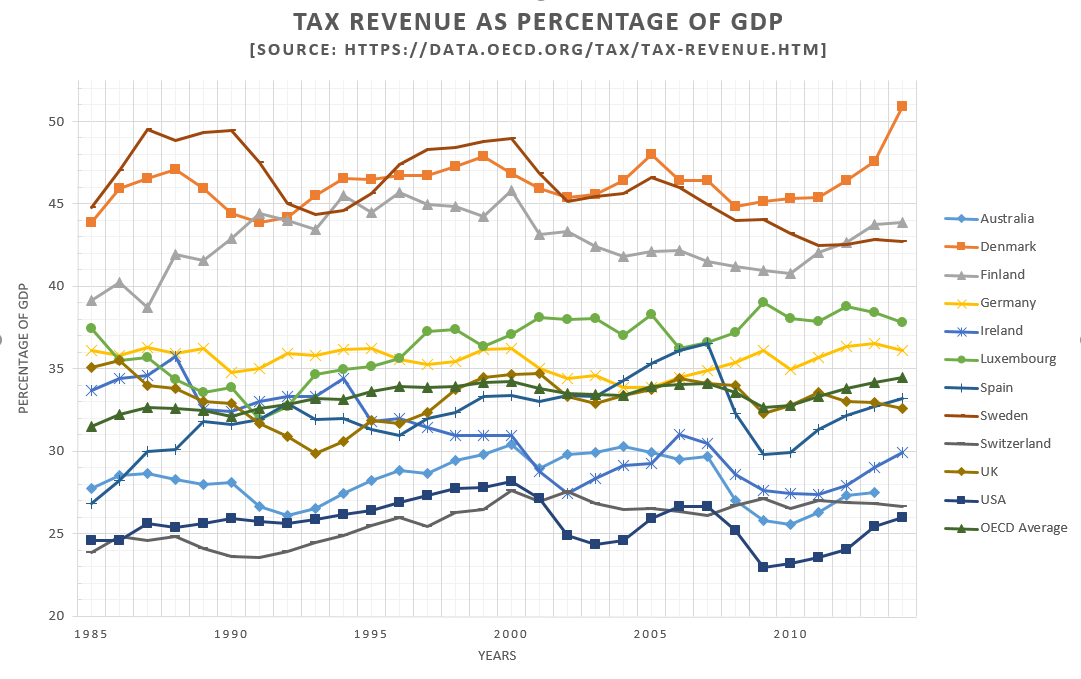

Capital gains taxes create a bias against saving leading to a lower level of national income by encouraging present consumption over investment.

. Unrealized gains are not taxed by the IRS. A tax on unrealized capital gains would be a direct tax because its a tax on personal property paid by someone who cannotquoting the Pollock decisionshift the burden upon some one sic. In reality it is a tax on wealth.

The distinction between unrealized and realized gainslosses is an important one because there are tax implications that could impact your tax bill at the end of the year. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. November 29 2021 by Brian A.

The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. 409 Capital Gains and Losses Source. Conversely unrealized gains and losses occur when you have yet to officially sell the investment.

Our estimate assumes that realizations are 20 percent less responsive to a change in the capital gains tax rate when unrealized gains are taxed at death. Ron Wyden D-Oregon announced on Tuesday that he is working on a mark-to-market system that would tax unrealized capital gains on assets owned by millionaires and billionaires. But just because you see some gains or losses.

Thats the Greenlight effect. The tax liability on realized gains depends on your income and how long you owned the investment. If you entered unrealized capital gains on federal remove them.

Ad The money app for families. The impacted assets include stocks bonds real estate and art. Unrealized capital gains are not reportable and not taxable.

If you are referring to realized capital gains you can adjust your capital gains in. If an investment is sold meaning that there is now a new owner of the investment the capital gain is considered to be realized Further if you realize a capital gain post-sale the proceeds are deemed taxable income. The tax would apply to people who make more than US 100 million a year for three years in a row or if one makes US 1 billion in annual income.

Just its just hard to do. Download the app today. Unrealized Capital Gains Tax Capital Gains Tax Rate 2022 It is widely believed that capital gains are the result of earnings made through the sale an asset such as stocks real estate stock or a company and that these profits constitute taxable income.

The tax paid covers the amount of profit the capital gain you made between the purchase price and sale price of the stock real estate or other asset. Taxing unrealized capital gains at death theoretically increases the revenue-maximizing capital gains tax rate because taxpayers are less likely to hold onto assets until death to avoid the higher rate. When you sell your gain or loss is referred to as realized.

This means you dont have to report them on your annual tax return. This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset. Currently the tax code stipulates that unrealized capital gains are not taxable income.

Currently taxpayers pay tax only on realized capital gains in. IRS Unrealized vs Realized Capital Gains. Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized capital gains of US.

An unrealized gain is an increase in your investments value that you have not captured by selling the investment. I mean I think I had a ton of unrealized capital gains last year and if I had to pay taxes on that I would have had to sell stocks. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes frequently resulting in double taxation. Currently the tax code stipulates that unrealized capital gains arent taxable income. What this means is that someone who owns stock or property that increases in value does not pay tax on that.

Households worth more than 100 million as part of his. It is the theoretical profit existent on paper. Such a tax is really a tax on wealth.

The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains. Taxing unrealized capital gains also known as mark-to-market taxation. This policy allowed the richest Americans to get richer by minimizing their tax obligations.

When it comes down to determining the amount you have to pay tax. What is an unrealized capital gain. Its normal to see the investments in your portfolio going up and down in value over time.

You only have a gain or loss when you sell a stock. Capital gains are only taxed if. Unrealized Capital Gain means with respect to any Reference Obligation if the Current Price of such Reference Obligation is greater than the Initial Price in relation to such Reference Obligation then a such Current Price minus such Initial Price multiplied by b the Reference Amount of such Reference Obligation.

The Capital Gains Tax And Inflation Econofact

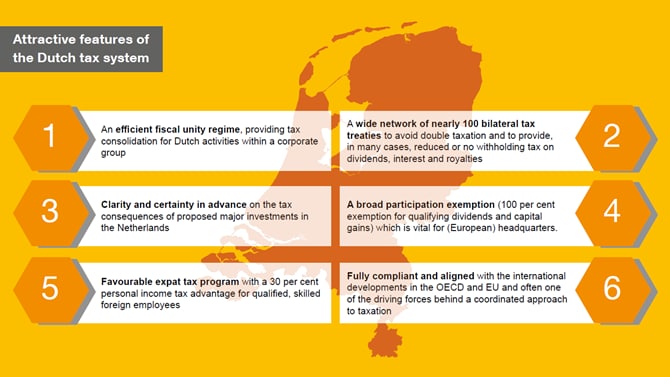

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax Would Buffett Prefer To Live In Holland

Capital Gains Tax In The Netherlands

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

Capital Gains Definition 2021 Tax Rates And Examples

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Many Users Are Confused When They Try To Report Their Backdoor Roth In Turbotax This Article Gives Detailed Step By Step Inst Turbotax Roth Federal Income Tax

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Capital Gain Tax In The Netherlands

R0609c A Gif 585 493 Cash Flow Statement Cash Flow Sample Resume

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

R0609c A Gif 585 493 Cash Flow Statement Cash Flow Sample Resume

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)